Amazon (NASDAQ:AMZN) released their Q2 earnings today after the market close today, July 29th. There was also an analyst conference call at 5:30 p.m. EDT.

Key Takeaways

- In the second quarter, Amazon's revenue fell short of analysts' expectations.

- Earnings came in at $15.12 per share, higher than estimates

- Analysts estimated an EPS of $12.47, up from 10.30 in Q2 2020

- The company also provided a lower-than-expected revenue forecast for the third quarter.

As experts predict the pandemic-induced surge in internet shopping to decrease, overall income was expected to grow, but at a slower rate than in prior quarters.

The stock fell more than 5% after the close on Thursday as this is their first revenue miss in 3+ years.

Disclaimer: The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

This was a pivotal quarter for Amazon as it was the last quarter of Jeff Bezos' tenure as CEO of the e-commerce and technology giant, as longtime corporate executive Andy Jassy took over on July 5. Andy Jassy, who helped create the company's massive cloud services division, will continue the company's expansion as the next CEO.

As Bezos said about his departure:

Right now I see Amazon at its most inventive ever, making it an optimal time for this transition.

As the Fool highlights, going into the earnings release investors were optimistic about Amazon's earnings announcement. For quite some time, the company has been outpacing Wall Street's revenue and profitability estimates. Its earnings beat analyst consensus estimates by 66% in Q1 of 2021, 95% in Q4 of 2020, 67% in the Q3 of 2020, and a whopping 606% in Q2 of 2020.

Revenue & Guidance Highlights

This quarter, earnings came in at $15.12 per share, higher than analyst estimates of 12.30 per share.

Revenue for the quarter came in at $113.08 billion, slightly lower than the 115.2 billion expected, according to CNBC. Revenue grew by 27% year-over-year, although it was still missed expectations.

Similarly, guidance for Q3 is between $106 billion and 112 billion, which is well below the consensus of 119 billion.

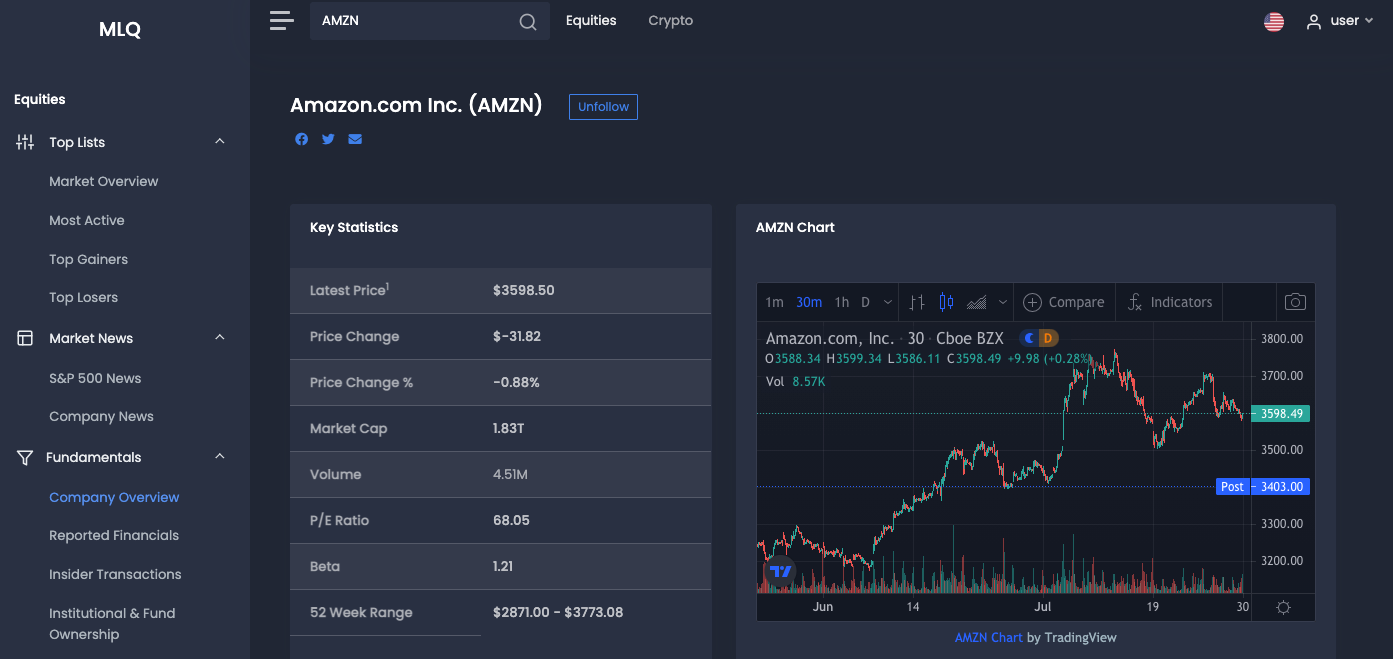

Amazon's stock is up 9% in 2021 through July 19, trailing the S&P 500's 14.3% gain. The stock is likely just taking a breather following its massive pandemic-fueled run-up last year, when it gained 76.3% — more than four times the wider market's 18.4% return.

Amazon stock has returned 92.1% since January 1, 2020, compared to 35.3% for the S&P 500.

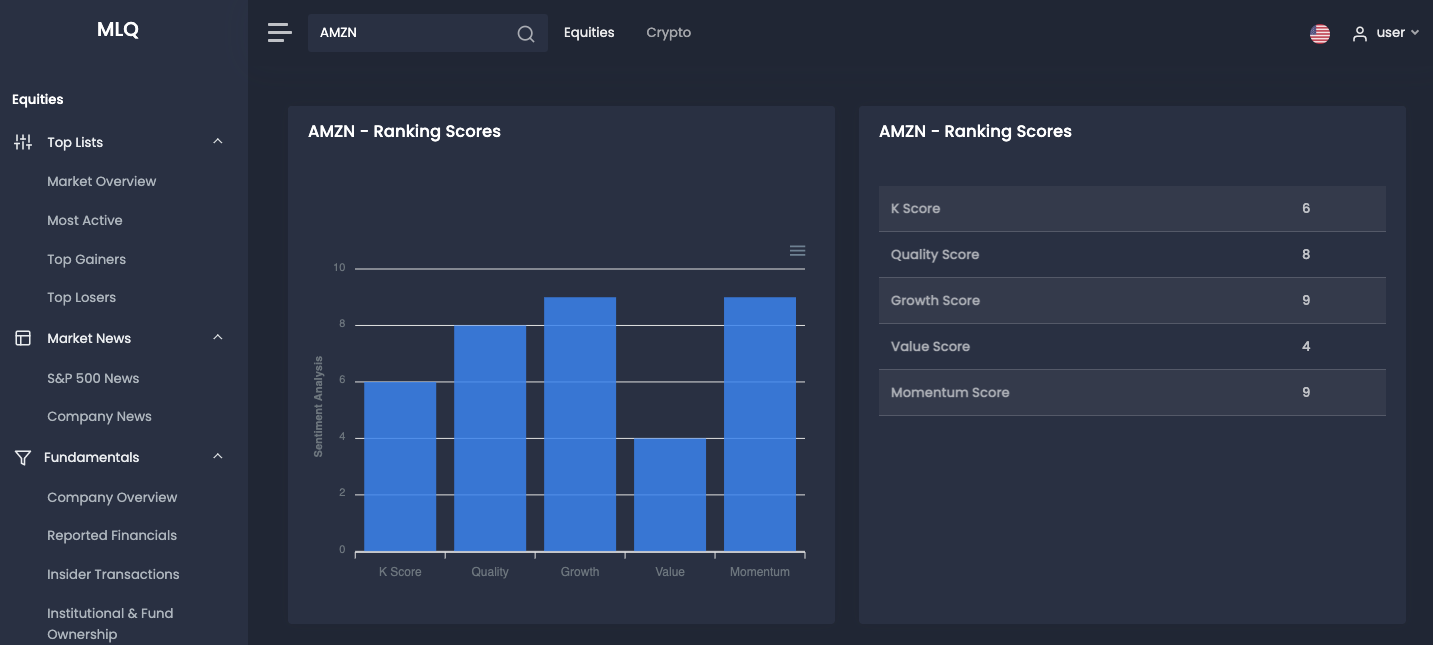

Machine Learning-Based Estimates

Below, let's look at how several ML-based indicators are ranking the stock at current levels.

- K Score of 6: K Score is a predictive equity ranking score between 0 and 9 with a high score indicating a higher probability of outperformance over the next month.

- Quality Score of 8: The Quality Score is indicative of how well-managed a company is how strong the financial health of the company is.

- Growth Score of 9: The Growth Score is indicative of a company's growth and related growth factors. These factors include but are not limited to ROA/ROE, YoY growth rate, and more.

- Value Score of 4: Value score indicates whether a stock is overpriced or underpriced at current levels.

- Momentum Score of 9: The momentum score measures the rate at which a company's price or volume is accelerating.

Overall, these ML-based indicators look quite bullish for Amazon.

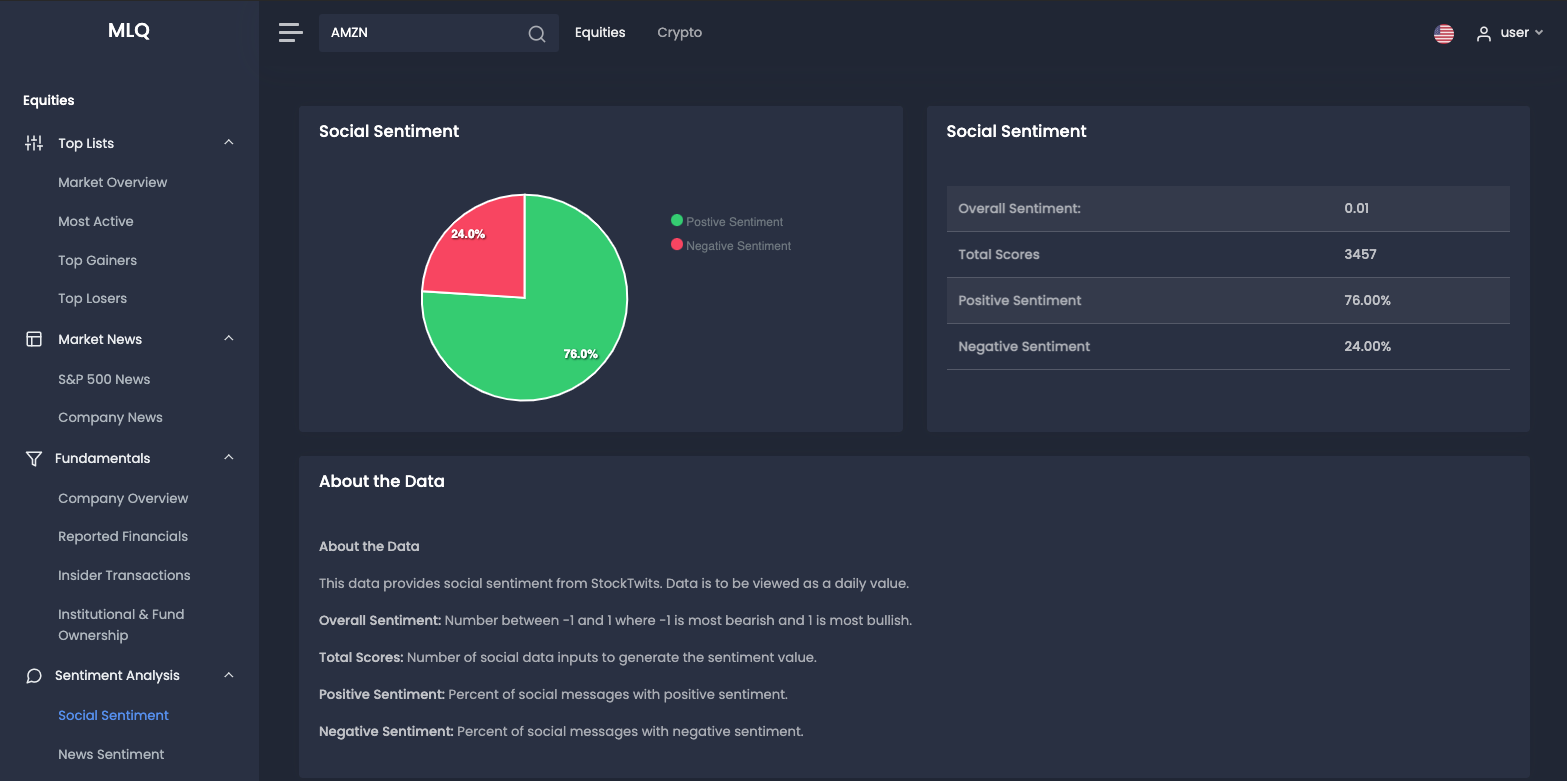

Social sentiment is still positive after the close on Thursday, with a 76% positive score and 24% negative sentiment, according to StockTwits data.

Now let's look further at how the quarter went relative to analyst expectations.

Amazon.com has seen its profitability and sales soar as the COVID-19 epidemic has prompted a shift to online shopping and cloud computing.

Going into the earnings release, investors were paying careful attention to the company's financial performance as well as Jassy's ambitions for future development.

Both profits per share (EPS) and sales were expected to increase, albeit at a slower rate than in prior quarters, according to analysts.

As Investopedia highlights, the company's cloud computing division was a focus for many investors as it provides such a high profit margin relative to eCommerce. Although AWS accounts for a modest portion of Amazon's overall sales, it produces a significant amount of the company's operating profits. AWS revenue growth was expected to decelerate somewhat in Q2, according to analysts.

In the Q2 release, AWS ended up growing its revenue by 37%, which is growing faster than the previous quarter's growth of 32%.

AWS posted revenue of $14.81 billion for the second quarter, which is more than analyst expectations.

What Investors Were Looking For

Going into the earnings report, many investors were watching to see how much of the company's extra eCommerce revenues from the epidemic will stick around as more and more traditional brick-and-mortar stores reopen.

The income earned by AWS, Amazon's cloud-computing platform, will also be scrutinized by investors. The AWS business provides significantly better margins than the company's e-mail business.

Despite a temporary uptick in FY 2018, Amazon's cloud revenue growth has decreased over the last five years. Analysts anticipated a 31.2% rise in AWS revenue in Q2 FY 2021, somewhat slower than the prior quarter.

AWS posted revenue of $14.81 billion in Q2, which surpassed analyst expectations of 14.2 billion.

At the end of the first quarter, AWS led the $150 billion global cloud market with a 32% share, well ahead of both Microsoft Corp.'s (MSFT) Azure and Alphabet Inc.'s Google Cloud.

Amazon Prime & Streaming

As Zachs Equity Research highlights, the success of Amazon's online retail business in the second quarter was believed to have been boosted by its expanding distribution network, Prime-enabled rapid delivery, and substantial grocery offerings.

Customers are likely to have flocked to Prime Free One Day, Amazon Fresh, and the Whole Foods Market's robust two-hour delivery service of natural and organic items including meat and seafood, fresh vegetables, and essentials in the quarter under review.

When it comes to streaming services, Prime Video's strong momentum was expected to have continued to be a key tailwind in the quarter. The expansion of original content, regional material, and the total content portfolio on Prime Video is expected to have boosted Prime subscriptions in the quarter.

Amazon Web Services (AWS)

The growing Amazon Web Services (AWS) portfolio was expected to help the company's second-quarter earnings, and as mentioned it did.

AWS posted revenue of $14.81 billion in Q2, which actually surpassed analyst expectations.

Below are several key highlights from the quarter highlighted by Zachs Equity Research:

- During that time, AWS announced the general availability of AWS App Runner, a fully managed container application solution.

- Amazon DevOps Guru, a fully managed operations service, is now available to the general public.

- The introduction of the public availability of Amazon FinSpace, an analytics service, is notable.

- Amazon Nimble Studio is now publicly available on AWS.

- The business has made AQUA for Amazon Redshift, a distributed and hardware-accelerated cache for Amazon Redshift, publicly available.

- Amazon Lookout for Equipment, an anomaly detection tool, is now publicly accessible on AWS.

- AWS has released Amazon Elastic Container Service (ECS) Anywhere and AWS Proton, a new functionality of Amazon Elastic Container Service (ECS), publicly accessible.

All of these new initiatives were expected to have aided AWS in gaining customers.

Smart Devices

Zachs Research also highlights the portfolio strength of Amazon's smart devices.

Amazon's growing lineup of Echo smart speakers is believed to have aided the company's second-quarter results.

During the second quarter, the firm introduced new Echo Show devices, including the new Echo Show 8, Echo Show 5, and the first Echo Show 5 Kids.

Aside from that, Amazon introduced the new Fire Kids Pro tablet for children aged 6 to 12 years, as well as the next-generation Fire HD 10 Kids tablet for children aged 3 to 7.

In the second quarter, the firm also released the next-generation Echo Buds, which include more sophisticated capabilities.

Amazon's improvement of Alexa capabilities is almost certain to have assisted in the delivery of a better user experience.

Third-Quarter Guidance

As the Fool highlights, since the stock market anticipates future events, the stock market's reaction to the next earnings report is often based on the company's third-quarter forecast rather than its second-quarter performance in comparison to Wall Street's expectations.

Amazon offers sales and operating income forecast but not profits guidance.

Analysts expected Amazon's revenue to climb 23% year over year to $118.6 billion in the third quarter, and its earnings per share to rise roughly 5% to 12.97.

The company provided a lower-than-expected revenue forecast for the third quarter.

Guidance for Q3 is between $106 billion and 112 billion, which is well below the consensus of 119 billion.