With new crypto and blockchain adoption coming from governments, corporations, and retail alike, 2021 has undoubtedly been a majorly bullish year for the cryptocurrency industry as a whole.

While there is still plenty of uncertainty around how crypto regulations will impact the industry, with China's crackdown on Bitcoin mining, this could be a major turning point as more and more US-based publicly listed stocks get involved in the industry.

In this guide, we've put together the top cryptocurrency stocks to watch, although keep in mind that these crypto stocks are not pure plays. Many of the companies on this list are just starting to dip their toes in the industry. That said, with the SEC hinting that they will likely approve US-based Bitcoin ETF in the near future, it's likely that many more investors will be looking to add crypto exposure to their portfolio if they haven't already done so.

With that in mind, below are the top cryptocurrency stocks to watch, which we've broken into the following categories:

- Crypto Exchanges

- GPUs & Computing

- FinTech & Software Providers

- Social Media Crypto Stocks

- Crypto ETFs

The top cryptocurrency stocks to watch include:

- Coinbase (COIN)

- Robinhood (HOOD)

- CME Group (CME)

- NVIDIA (NVDA)

- Advanced Micro Devices (AMD)

- PayPal (PYPL)

- Square (SQ)

- Visa (V)

- MasterCard (MA)

- MicroStrategy (MSTR)

- SoFi Technologies (SOFI)

- Facebook (FB)

- Twitter (TWTR)

- Purpose Bitcoin ETF (TSX: BTTC)

- Amplify Transformational Data Sharing ETF (BLOK)

Stay up to date with AI

Disclaimer: The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice. See out full Terms of Service for more information.

Crypto Exchanges

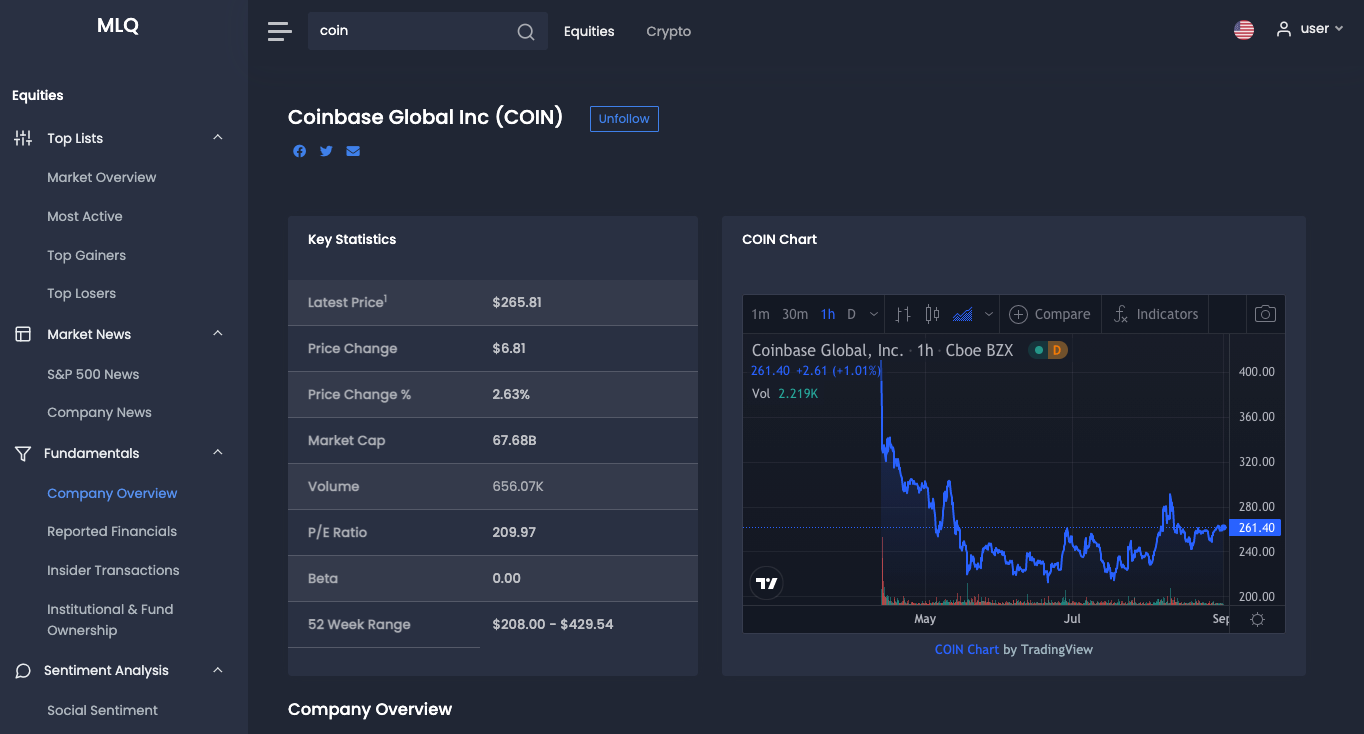

1. Coinbase (COIN)

As volumes in cryptocurrency trading have soared in the past year, particularly in Bitcoin, Ether, and Dogecoin, Coinbase (COIN) is a clear market leader in the crypto exchange industry.

Coinbase had its IPO on April 14 this year and was priced at $250 per share. Following their IPO, the stock has slumped a bit and is currently down roughly 35% from its public debut. This decline in share price, however, may be due to the fact that major cryptocurrencies like Bitcoin have also dropped in price during the time period.

For their first earnings release on May 12th, Coinbase missed their earnings estimates slightly as they reported EPS of $3.05, missing the consensus by 2 cents a share. Despite the initial earnings miss, Coinbase beat Q2 earnings by a massive margin—reporting $6.42 per share. Estimates for the quarter were only $2.82, so this was a big quarter for the company.

Even though Coinbase beat Q2 estimates by a huge margin, the company did say they expected guidance to be lower in the coming quarters as trading volumes may decline over this time. Regardless of their first two quarterly releases, there's no question that Coinbase is a mainstay in the crypto industry and is certainly a stock to watch.

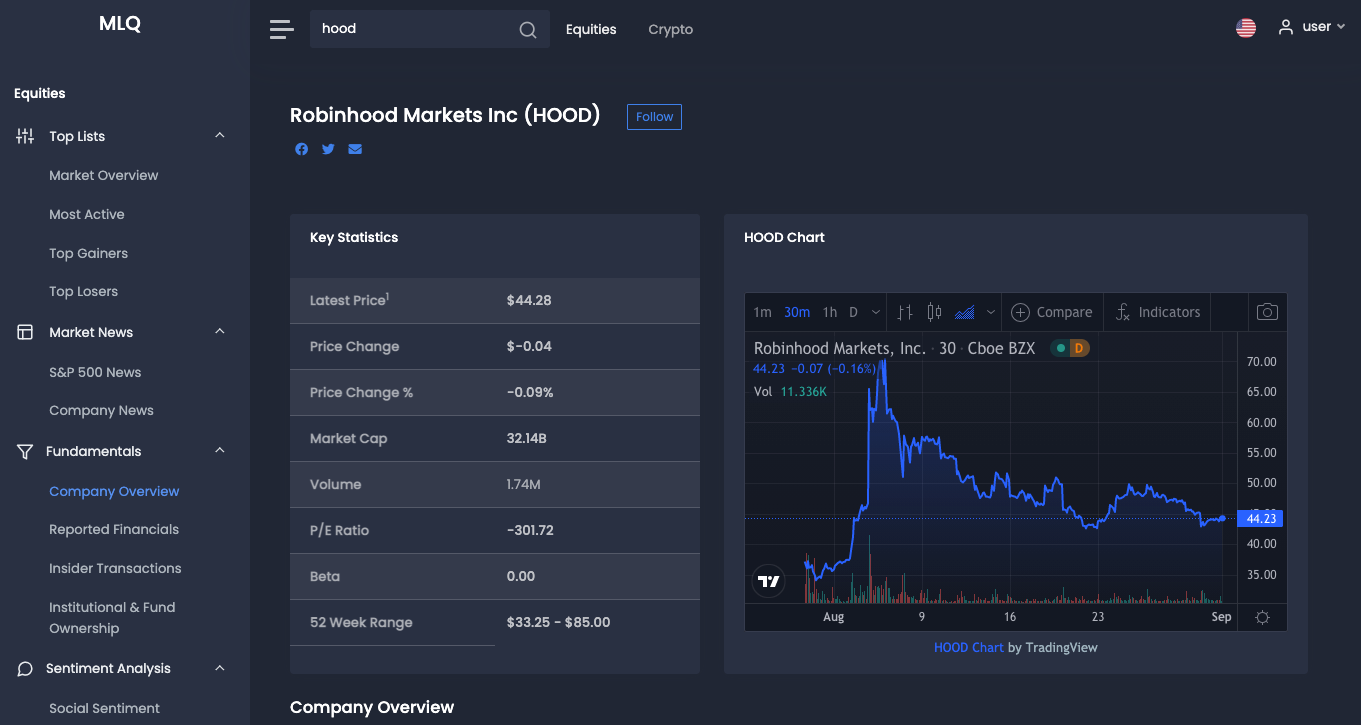

2. Robinhood (HOOD)

Another major exchange that has benefited from the boom in crypto trading is Robinhood (HOOD). Robinhood is not strictly a crypto exchange and offers equity and options trading, although cryptocurrency trading has been a major part of their revenue recently. In fact, the company recently reported their Q2 earnings, which highlighted that commissions from cryptocurrency trading accounted for a massive 41% of their revenue. What's more shocking is that Dogecoin trading accounted for 62% of their cryptocurrency revenue for the quarter.

As the company stated in their earnings report, this heavy reliance on Dogecoin trading commission may cause revenue to slump in the coming quarters if volumes for the meme-crypto decline and are not replaced by new demand for other cryptocurrencies.

Aside from crypto trading commissions, the top question that retail shareholders had for Robinhood after their latest quarterly report was whether the exchange would offer a crypto wallet. A crypto wallet would allow Robinhood users to transfer and withdraw their crypto assets to and from other exchanges.

While there is a lot of enthusiasm for a crypto wallet at Robinhood, the CEO said that they have plans to offer one, although building one is "tricky to do at scale". Given their massive user base, it makes sense that they want and need to get this right the first time. The CEO also stated that they plan to offer more crypto assets on the platform, making Robinhood another crypto stock to watch in the coming quarters.

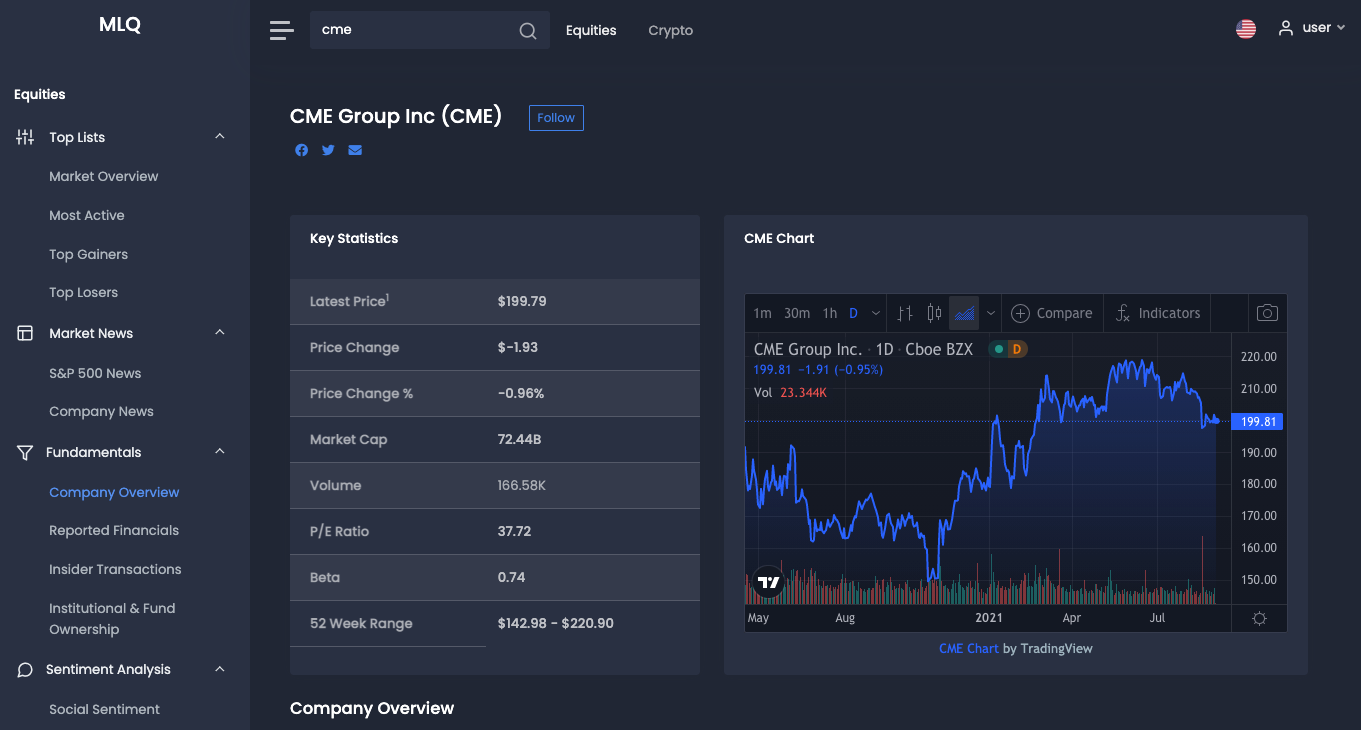

3. CME Group (CME)

CME Group (CME) is another exchange that offers investors exposure to crypto through their Bitcoin and Ether Futures contracts. One Bitcoin futures contract at the CME exchange is equivalent to trading 5 bitcoin, although in 2021 they also introduced Micro Bitcoin futures (MBT) contracts. These Micro Bitcoin futures contracts are equivalent to 1/10th of one bitcoin or 1/50th of the larger BTC futures contract.

CME Group recently posted an increase in Q2 profits, which the company noted was partially driven by their new products like the Bitcoin Micro futures products.

In addition to Bitcoin Futures, CME offers futures contracts for Ether, which are likely to draw in more institutional demand in the coming years. Also, as investors want to add more crypto exposure to their portfolio, it's likely CME will continue offering new futures contracts for the most popular assets.

GPUs & Computing

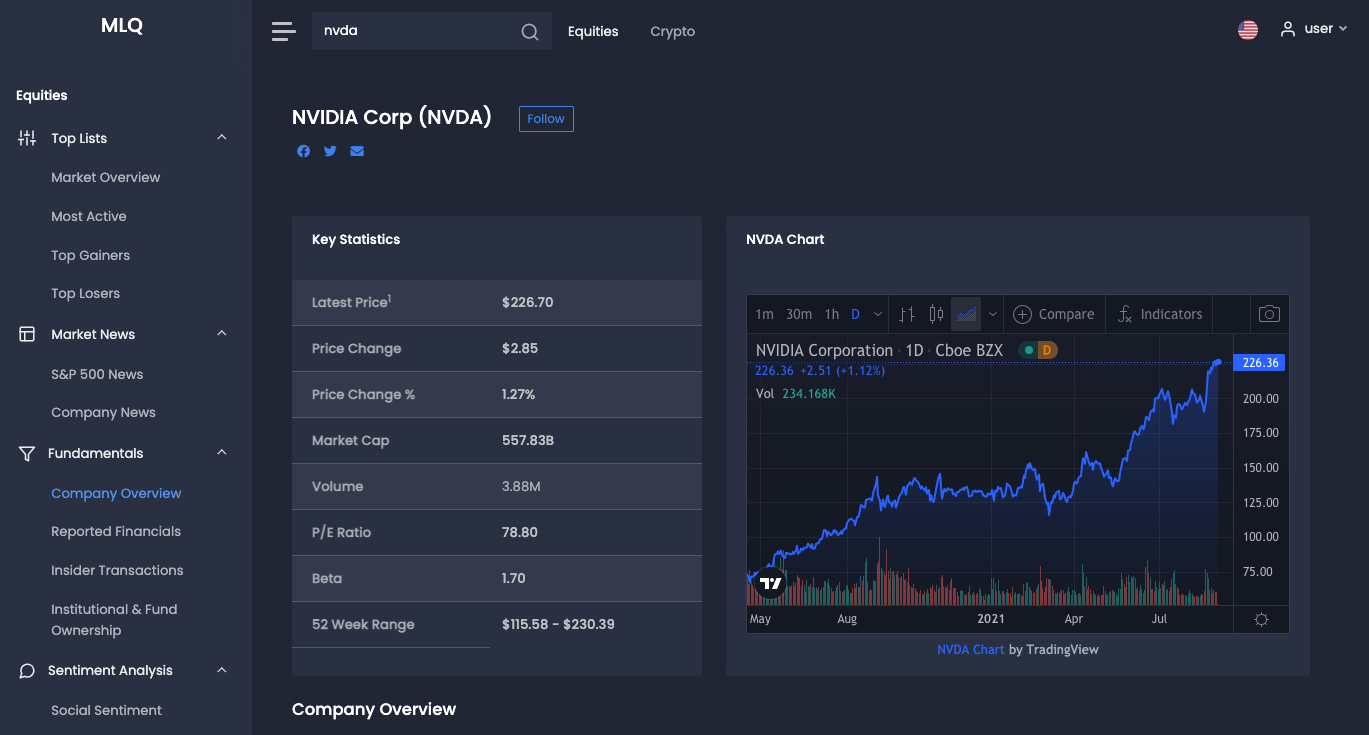

4. Nvidia (NVDA)

Nvidia (NVDA) is a notable player in the crypto space as they offer GPUs that are built specifically for mining. The majority of their revenue comes from GPUs related to gaming, although their crypto mining equipment is certainly a growing sector of the business as they just reported blowout earnings for Q2 2021. In particular, the company increased revenue by 68% year over year.

As the CFO stated in Q1 2021, the company expected $400 million in revenue from crypto mining processors (CMP),. The actual revenue from crypto mining processors came in at just $266 million for the quarter, although their gaming and data center revenue more than made up for this. Regardless, Nvidia is certainly a crypto mining stock to watch in the coming quarters.

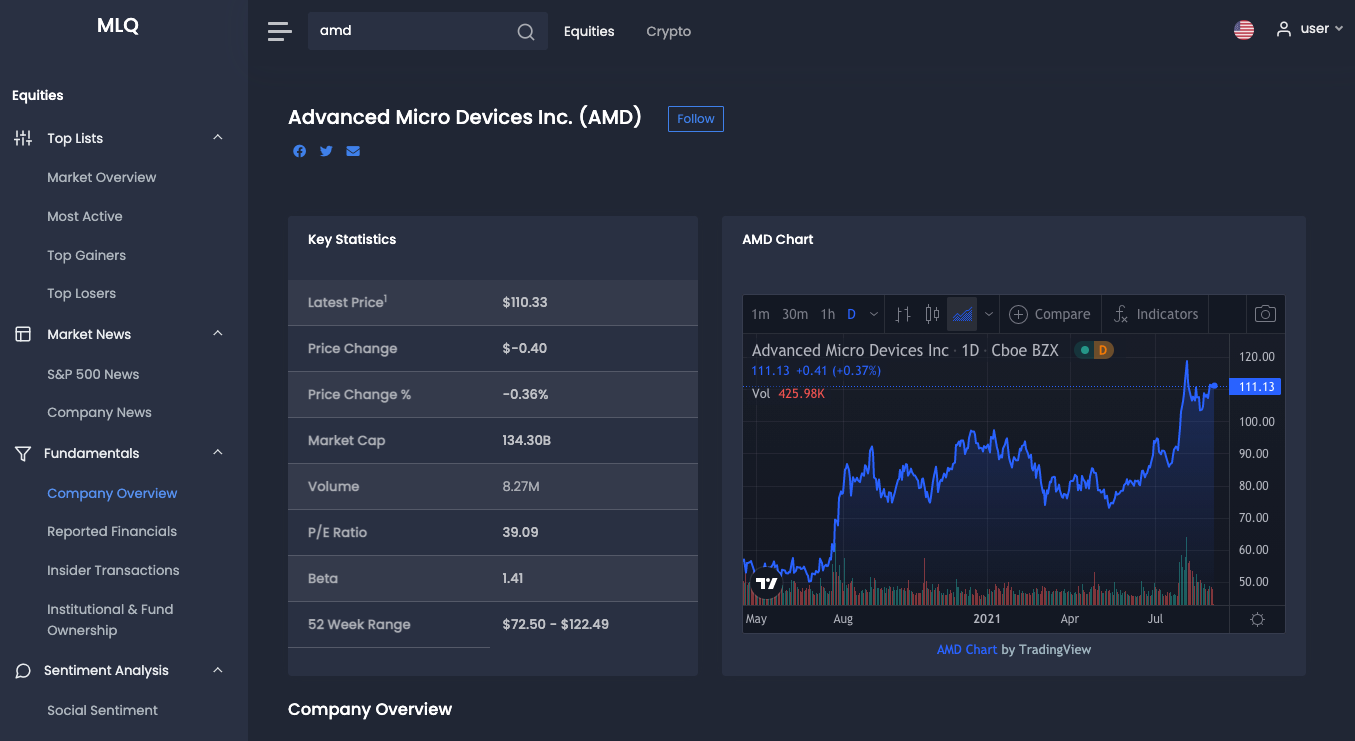

5. Advanced Micro Devices (AMD)

Another notable company in the crypto space is Advanced Micro Devices (AMD), which produces PC graphics cards, including GPUs and CPUs that can be used for mining cryptocurrency. One difference between Nvidia and AMD is that AMD stated that they have no intention of blocking crypto mining operations. This is contrasted to Nvidia, which places limits on their gaming GPUs, specifically an Ethereum mining limiter. The goal with this limit by Nvidia was to dissuade professional miners from buying up the gaming-specific product. As AMD stated:

We don’t have any plans to introduce a mining limiter on Radeon graphics cards at this time

In addition to mining, AMD also states on their site that they're looking at other use cases in the crypto space, including blockchain-based gaming and more.

FinTech & Software Providers

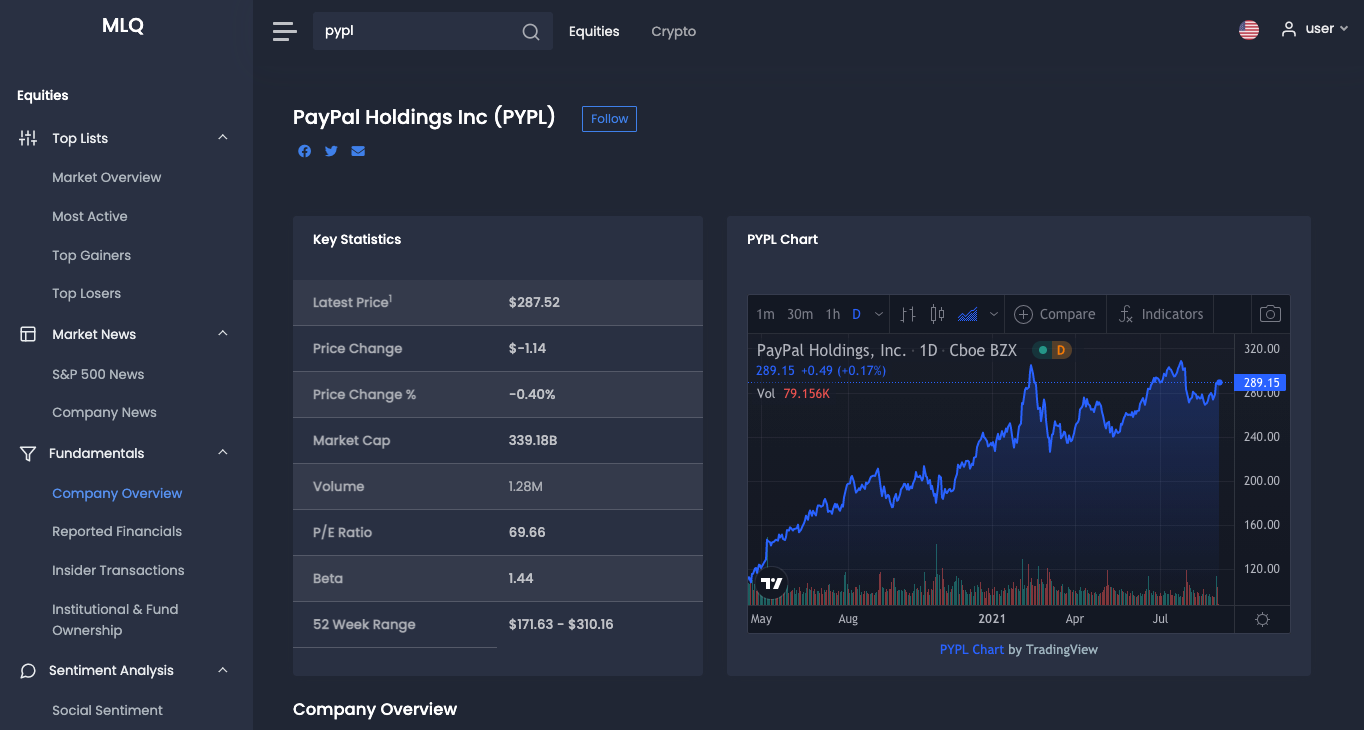

6. PayPal (PYPL)

In the fintech and payment provider space, PayPal (PYPL) has already made their intention clear that they're going to enter the crypto space in a big way. First off, last year the company provided their U.S. customers with the ability to buy, sell, hold, and even checkout with several cryptocurrencies including Bitcoin, ether, Bitcoin Cash, and Litecoin. PayPal also just rolled out this option for their UK users also well. In addition, the mobile wallet app Venmo that PayPal owns allows users to buy and sell crypto.

On top of letting retail customers buy, sell, hold, and checkout with crypto, PayPal also recently acquired Curv, which provides "digital asset security infrastructure". As Curv states:

Curv eliminates this single point of failure by giving you a secure, distributed way to sign transactions and manage all your digital assets.

Although PayPal is still in the early days of rolling out cryptocurrency-related products and services, they're clearly going to be a major competitor in the market in the coming years.

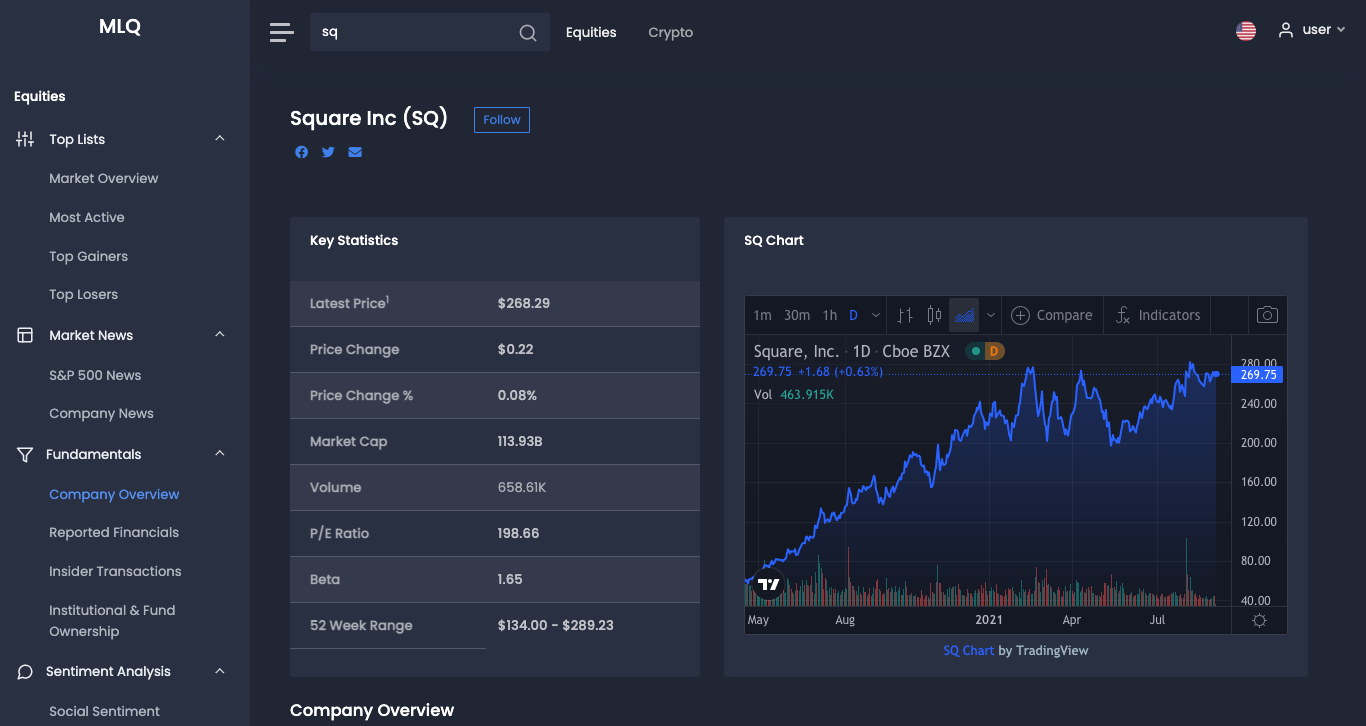

7. Square (SQ)

Another payment services provider that is entering the crypto space is Square (SQ). Led by Jack Dorsey who is a major proponent of Bitcoin, the CEO recently tweeted that they will be creating a new business focused on building an open developer platform. The goal of this platform will be to make non-custodial, permissionless financial services, with a primary focus on Bitcoin:

Square is creating a new business (joining Seller, Cash App, & Tidal) focused on building an open developer platform with the sole goal of making it easy to create non-custodial, permissionless, and decentralized financial services. Our primary focus is #Bitcoin. Its name is TBD.

— jack⚡️ (@jack) July 15, 2021

In addition to this new business, the company also recently announced they will be building a Bitcoin hardware wallet. Their goal with this wallet is to make Bitcoin custody more mainstream:

We have decided to build a hardware wallet and service to make bitcoin custody more mainstream. We’ll continue to ask and answer questions in the open. This community’s response to our thread about this project has been awesome - encouraging, generous, collaborative, & inspiring. https://t.co/CHf9hAmKnn

— Jesse Dorogusker (@JesseDorogusker) July 8, 2021

Finally, Jack Dorsey also just announced Square's plan to build a decentralized Bitcoin exchange through their TBD division. Dorsey tweeted the dex would be completely open-source and permissionless, although unlike other dexes like Uniswap, will provide users with a variety of fiat on-ramp options:

We’ve determined @TDB54566975’s direction: help us build an open platform to create a decentralized exchange for #Bitcoin https://t.co/jHYWHy1qmu

— jack⚡️ (@jack) August 27, 2021

Given the size and already mainstream status of Square, it's likely that these new initiatives will increase the adoption of cryptocurrency.

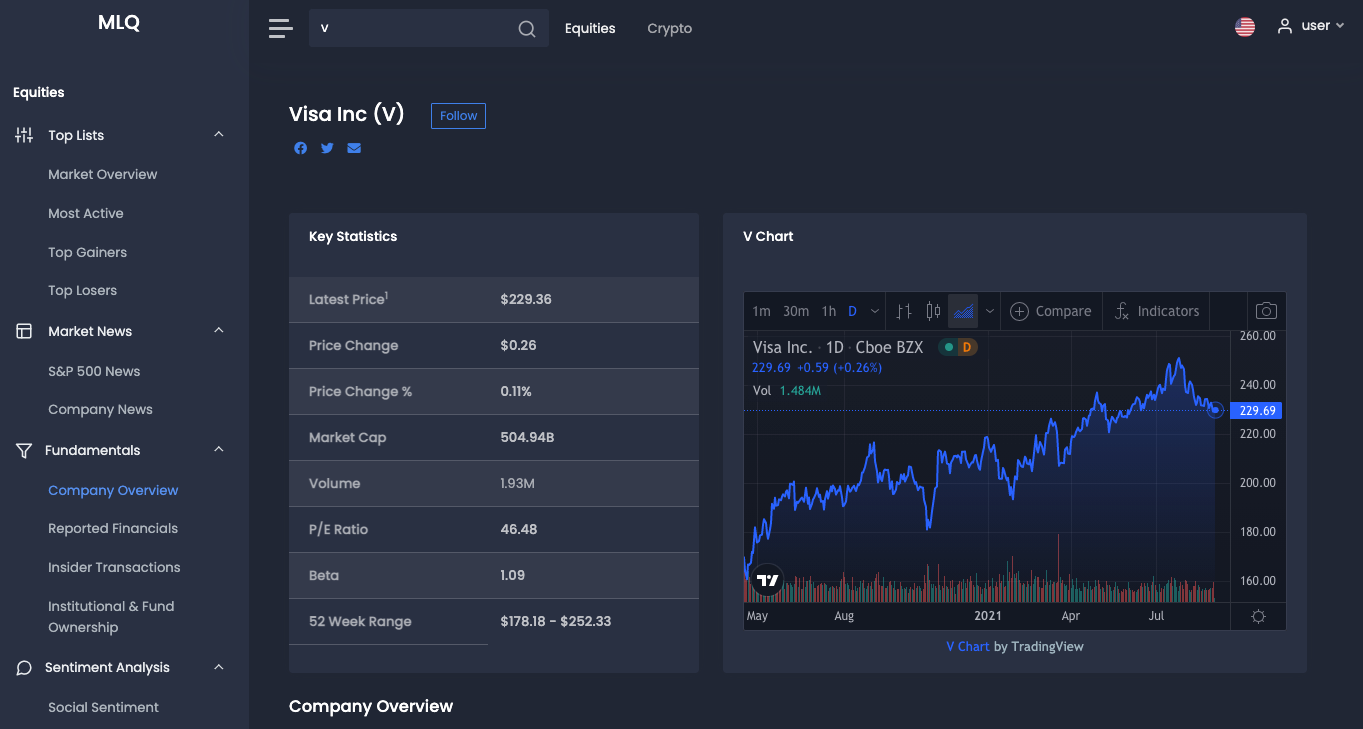

8. Visa (V)

Visa (V) is another payment provider that has made its intentions to enter the crypto space clear this year. As Forbes highlights, the company has partnered with 35 Bitcoin and cryptocurrency companies in previous years. The company also announced its plans to help banks enter the crypto buying and trading space with various Visa crypto software solutions.

Currently, their crypto solutions include Visa Fintech Fast Track, which allows companies to "connect to Visa’s vast payment network and have Visa credentials issued to your users". The company also offers Visa Crypto APIs, which can be used to allow users to buy and sell Bitcoin and other cryptocurrencies.

More recently, Visa has been in the crypto news for their purchase of a CryptoPunk, which is one of the first non-fungible tokens (NFTs) on the Ethereum blockchain. As a Visa executive told MarketWatch:

We want to have a seat at the table as the crypto economy evolves. By participating actively in this space, we gain deeper firsthand knowledge, ultimately allowing us to better support our customers as they enter the space.

With this purchase, Visa is the first major company to put an NFT on their balance sheet, although they almost certainly won't be the last.

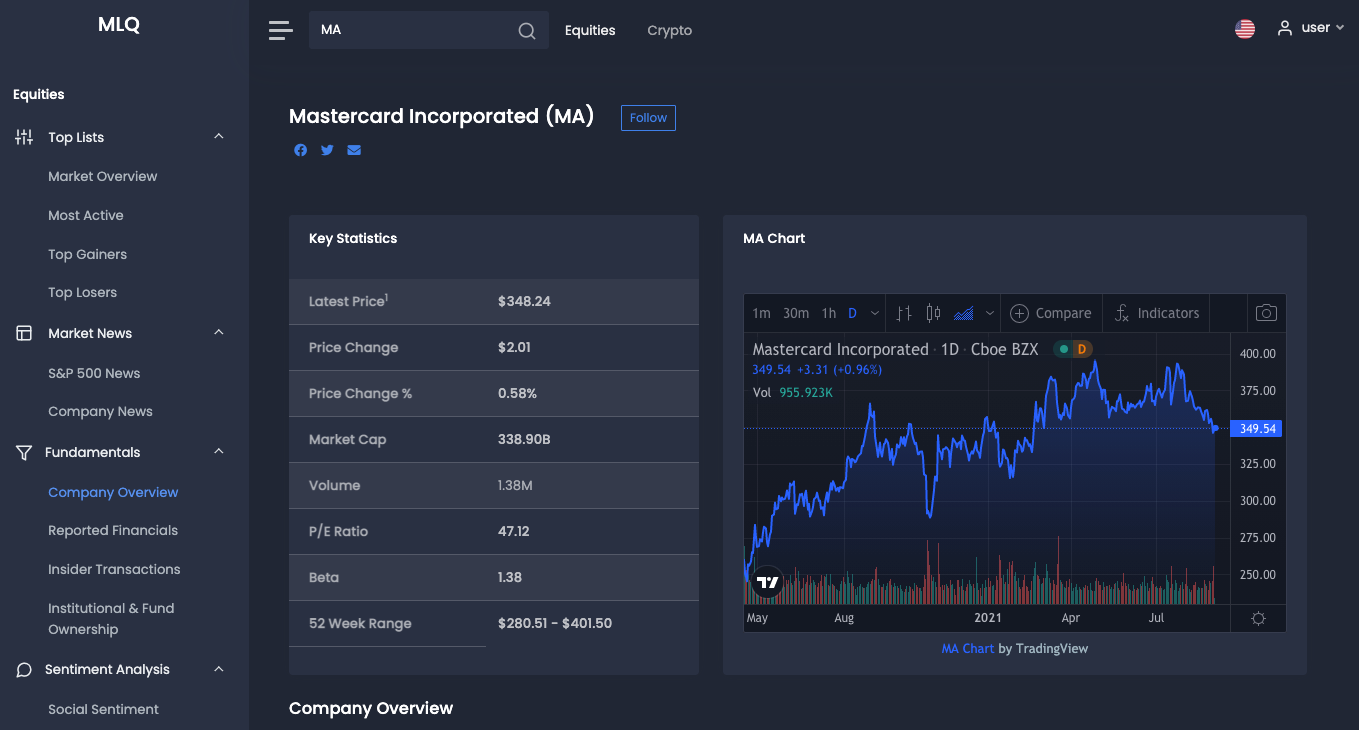

9. MasterCard (MA)

Earlier this year, Mastercard (MA) announced they will be bringing crypto onto their network. The company mentioned already has 89 blockchain patents globally and 285 more blockchain patent applications that are pending. Mastercard said they will limit the number of cryptocurrencies allowed on the network, although it's still unclear which ones will be accepted.

More recently, MasterCard said they enhance their card program for crypto wallets and exchanges. The goal here is to make it easier for their partners to convert cryptocurrency into fiat currency. Finally, the company also just announced its Start Path, which is a startup program designed to support digital asset, blockchain, and cryptocurrency companies.

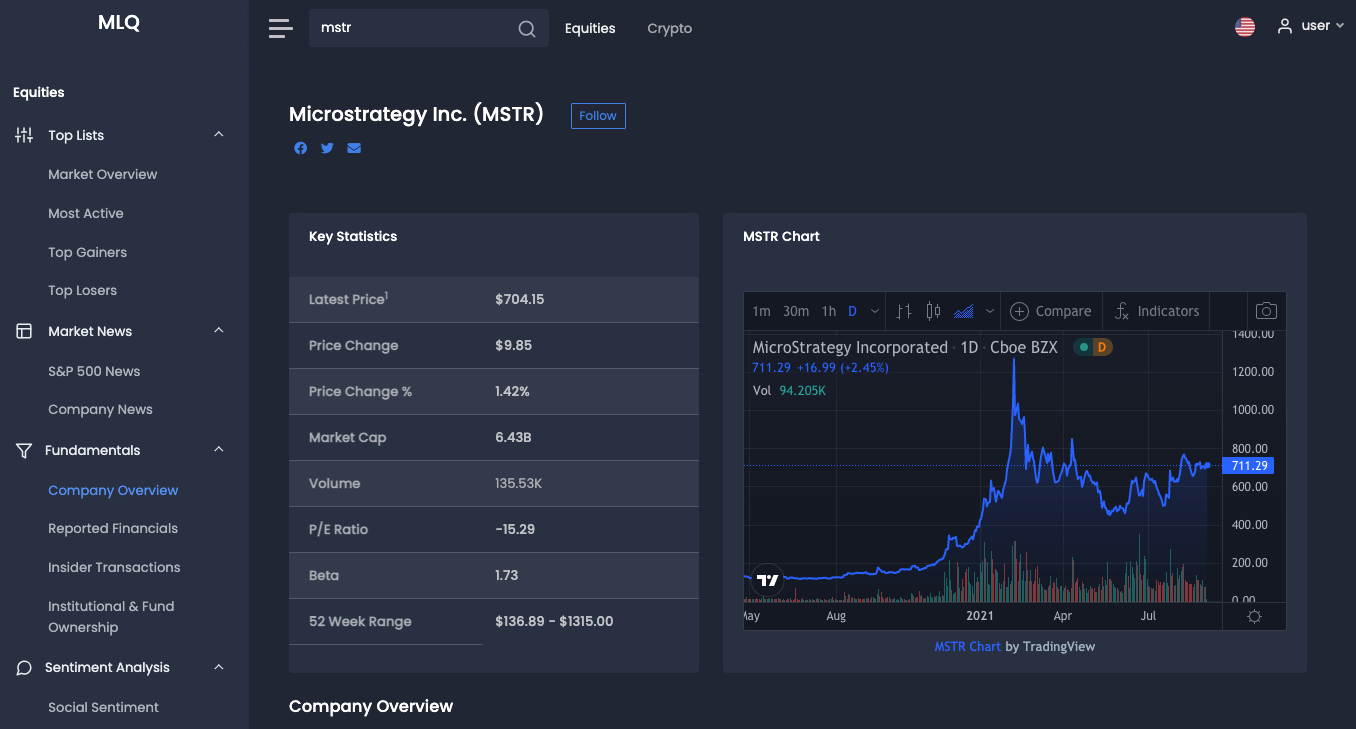

10. MicroStrategy (MSTR)

MicroStrategy (MSTR) is a business intelligence company that provides a suite of mobile software and cloud-based services. Although their analytics platform doesn't deal with cryptocurrency directly, Microstrategy is on this is as they own the most bitcoin of all publicly traded companies. As Decrypt editor in chief told Yahoo Finance, with over 100,000 bitcoin on their balance sheet, calling this company just a cloud services or business intelligence company doesn't feel completely accurate anymore.

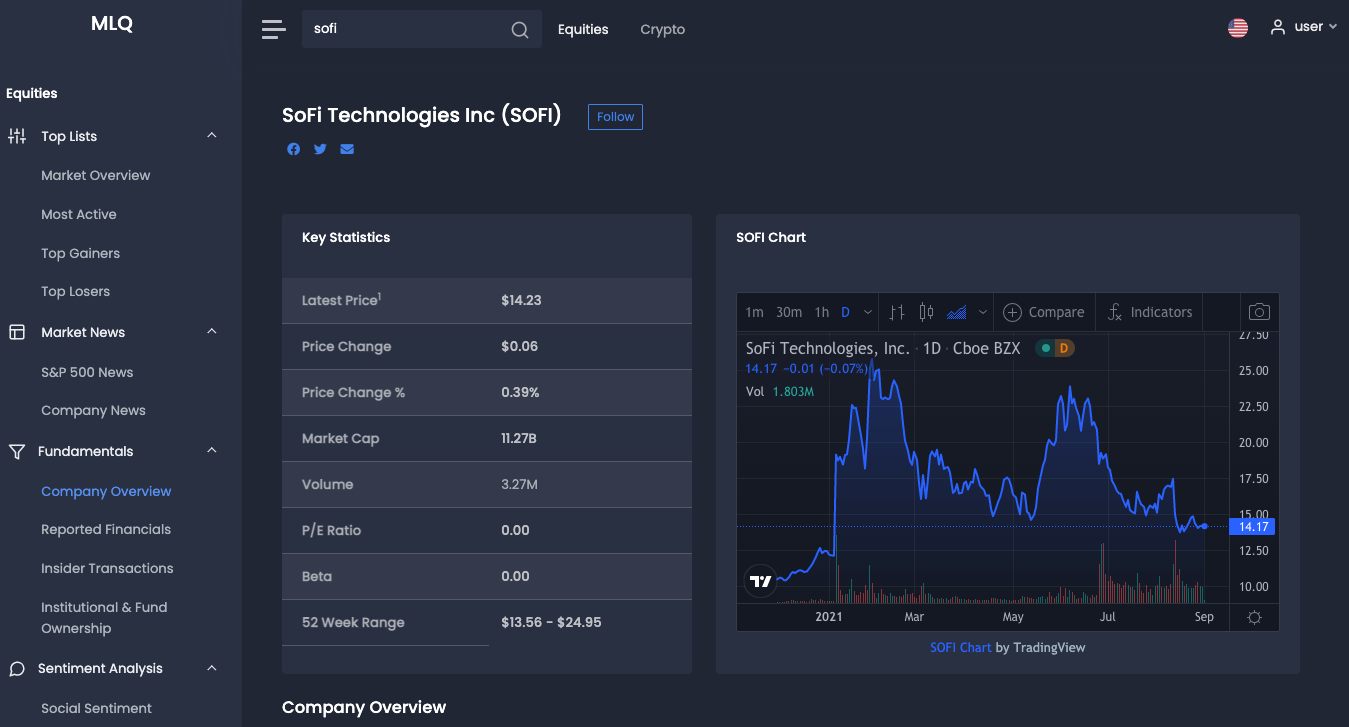

11. SoFi Technologies (SOFI)

Sofi Technologies (SOFI) is another fintech company that provides a complete suite of personal finance products and services. These include student loan refinancing, mortgages, personal loans, credit cards, traditional investing and banking, and the ability to buy, sell, and hold cryptocurrency. There are currently offer 21 cryptocurrencies available on the platform

Social Media Crypto Stocks

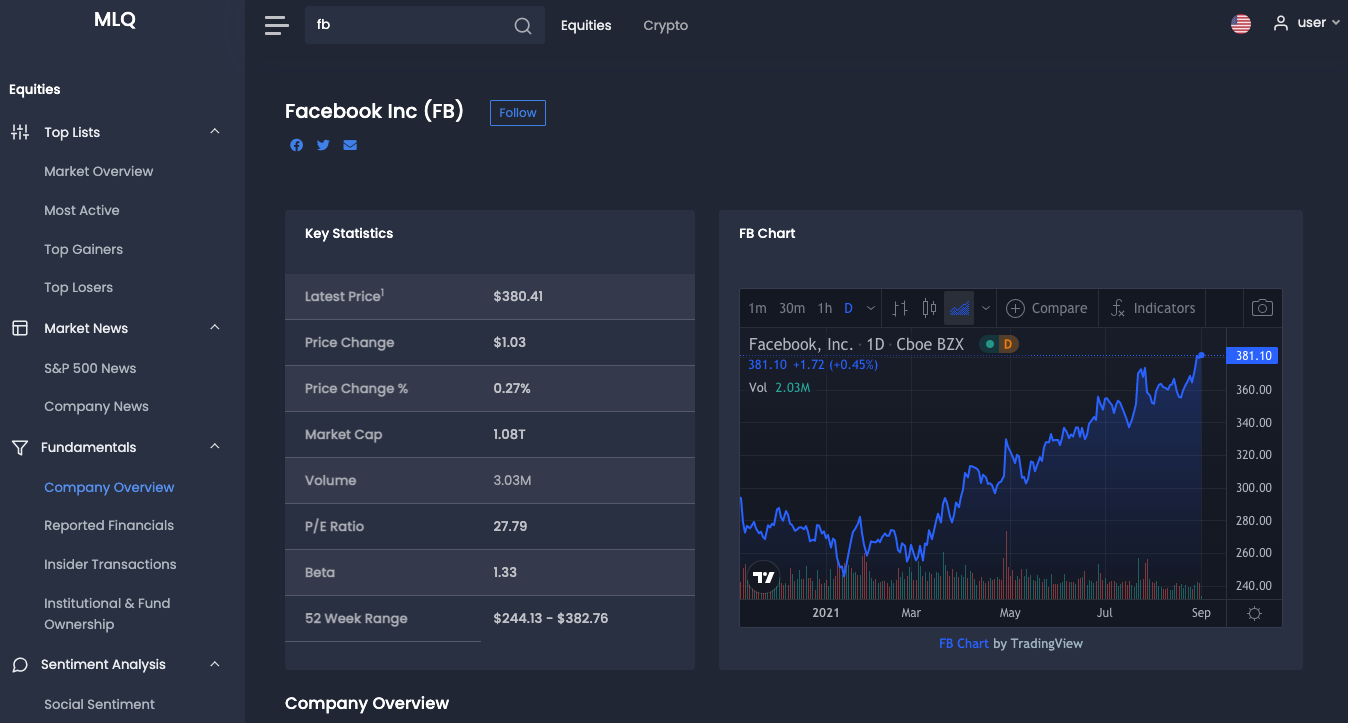

12. Facebook (FB)

In terms of social media companies, Facebook (FB) has been exploring the space for several years. First proposed in 2019, their Libra cryptocurrency project was to create a Libra token that would be tied to a basket of currencies and would be at the centerpiece for their digital payments strategy. After significant regulatory pressure, the project shifted and is now called Diem and is set to launch a pilot project sometime this year. The Diem Association is now planning to launch with a single stablecoin pegged to the U.S. dollar.

In addition to their Diem stablecoin project, Facebook also recently announced Novi, which is a "digital wallet for the Diem payment system". As the head of Novi David Marcus told Bloomberg, the project is also "definitely thinking about" adding support for non-fungible tokens (NFTs) to the project.

Although Facebook has delayed its digital payment plans several times, there's no question that if they get it right they will be a major crypto stock to watch.

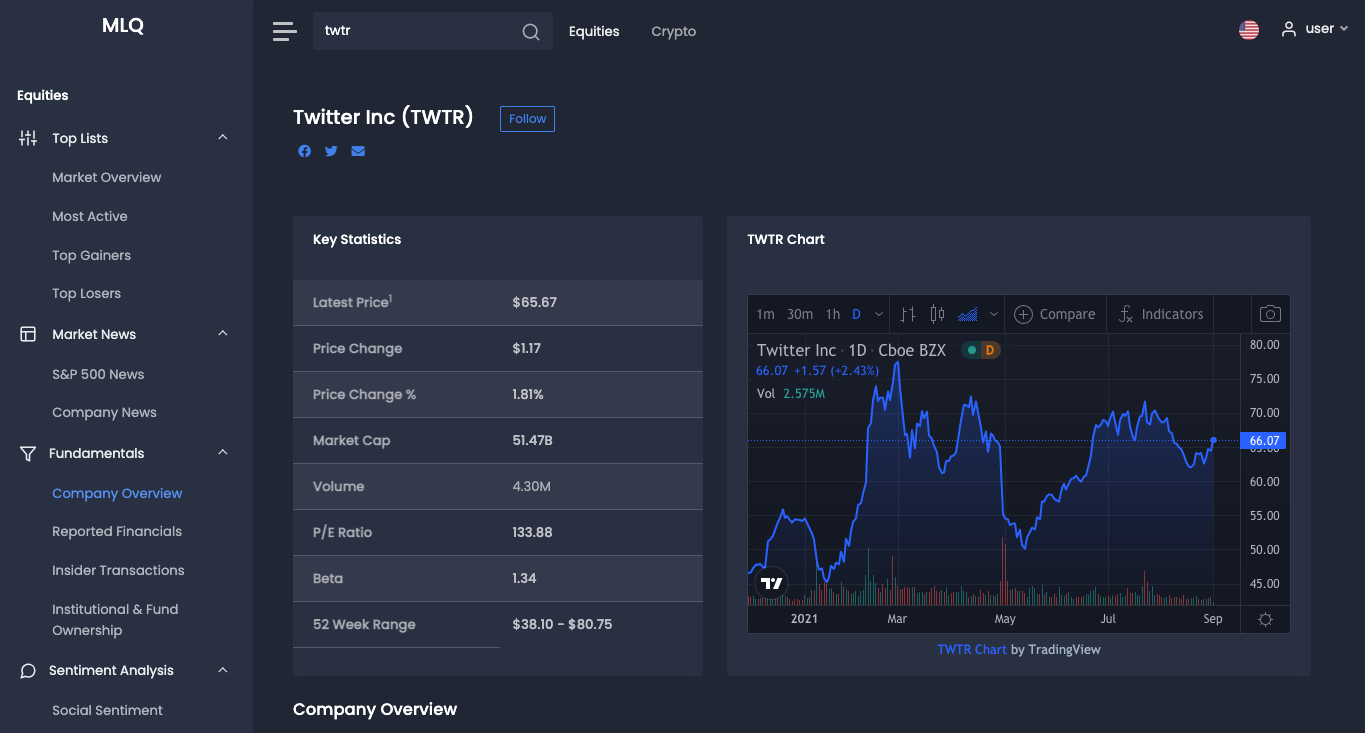

13. Twitter (TWTR)

Another social media cryptocurrency stock to watch is Twitter (TWTR), as the CEO Jack Dorsey told investors that Bitcoin will play a "big part" of the company going forward. A few of the opportunities that Dorsey has mentioned at include adding a Twitter Tip Jar feature that would allow users to make micro-payments on the platform.

The company also teased Super Follows and Ticketed Spaces, which would add other paywalls on the platform that could incorporate crypto payments. Given that Dorsey is such a proponent of Bitcoin and building infrastructure to support crypto at Square, it makes sense that Twitter follows a similar trajectory and explores several blockchain-based products and services.

Crypto ETFs

14. Purpose Bitcoin ETF (TSX: BTTC)

If investors want exposure to bitcoin directly as opposed to companies building in the crypto space, Purpose Bitcoin ETF is the first bitcoin ETF and trades on the Canadian TSX exchange.

BTTC directly purchases bitcoin on your behalf and stores it in cold storage (i.e. off-exchange) and carries a management fee of 1%. Although there are still limited crypto ETF options, that is highly likely to change soon as the SEC is in ongoing regulatory talks about approving a US-based option.

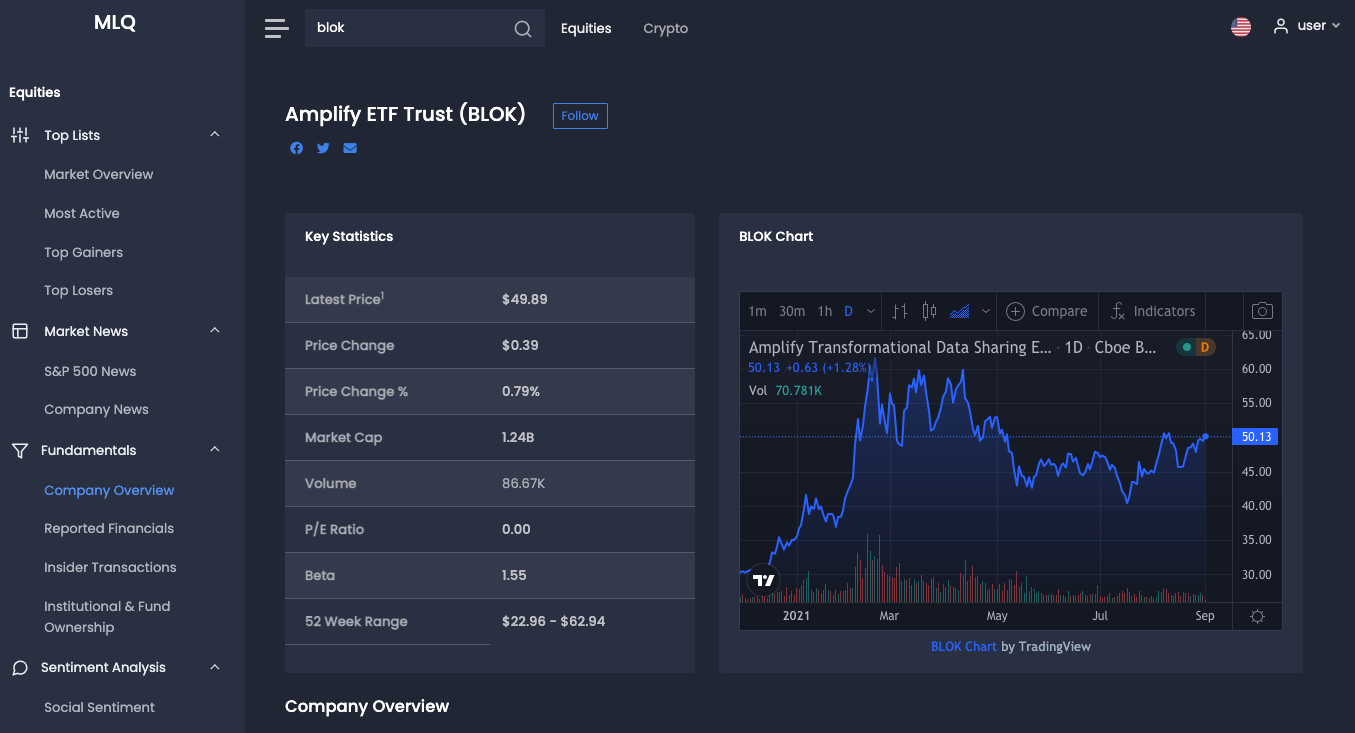

15. Amplify Transformational Data Sharing ETF (BLOK)

Finally, although the SEC hasn't yet approved a US-based Bitcoin ETF at the time of writing, there are still several crypto ETFs that investors can use to gain exposure to the space—Amplify Transformational Data Sharing ETF (BLOK) is one such option. BLOK is an actively managed ETF in invests in companies that are "actively involved in the development and utilization of blockchain technologies". Several companies in their holdings include Micr0Strategy, Square, PayPal, amongst others.

That's it for our top cryptocurrency stocks to watch, we'll be sure to keep this list updated as more and more companies enter the space.