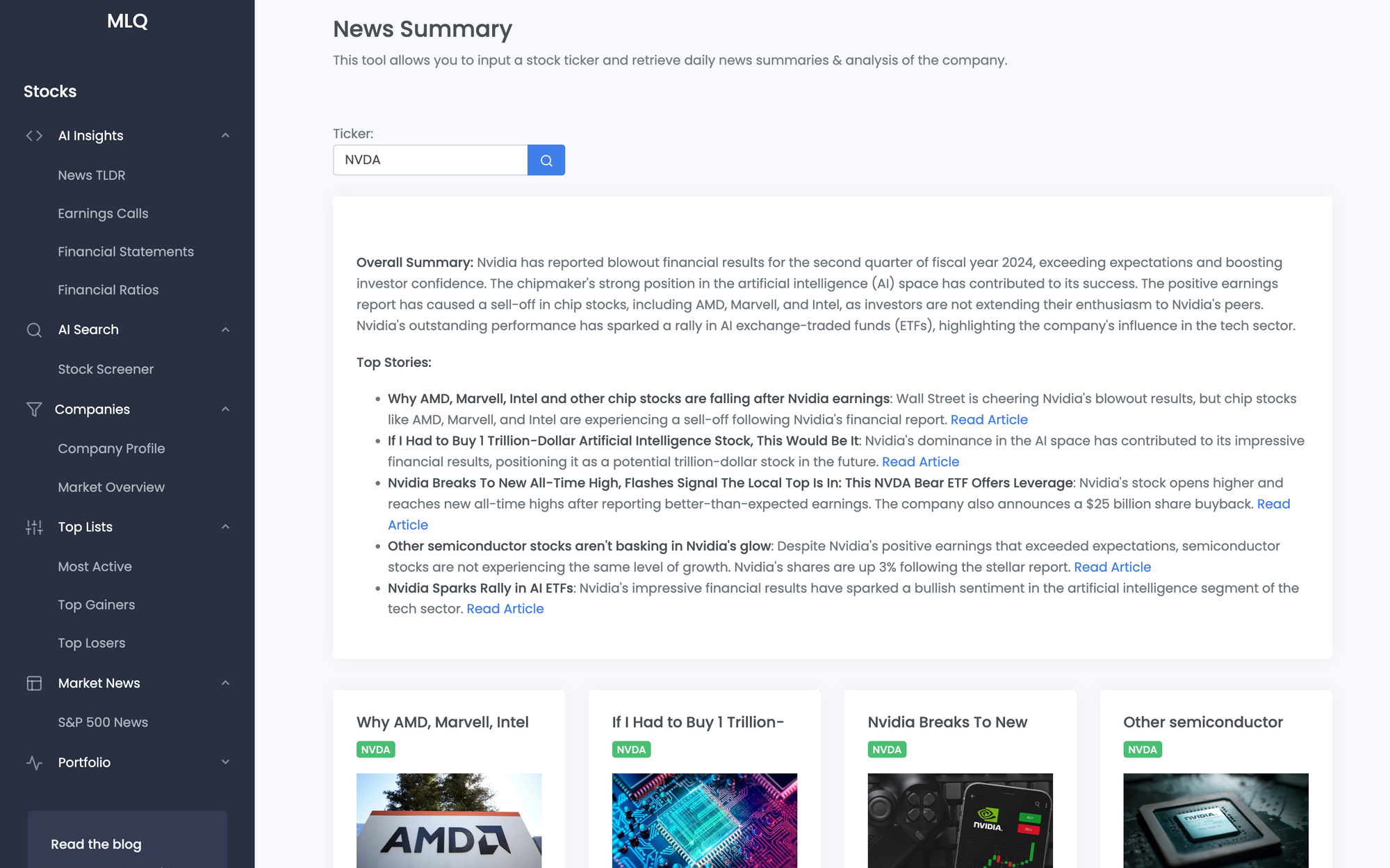

Nvidia (NVDA) hit an all time high after reporting strong financial results for the fiscal 2024 second quarter, surpassing expectations and leading to a surge in its stock price. The company's dominant position in the artificial intelligence space contributed to its success.

Nvidia also announced a $25 billion share buyback, which further boosted investor confidence. The positive earnings report had a ripple effect, sparking a rally in AI-focused exchange-traded funds (ETFs) and generating bullish reactions from analysts.

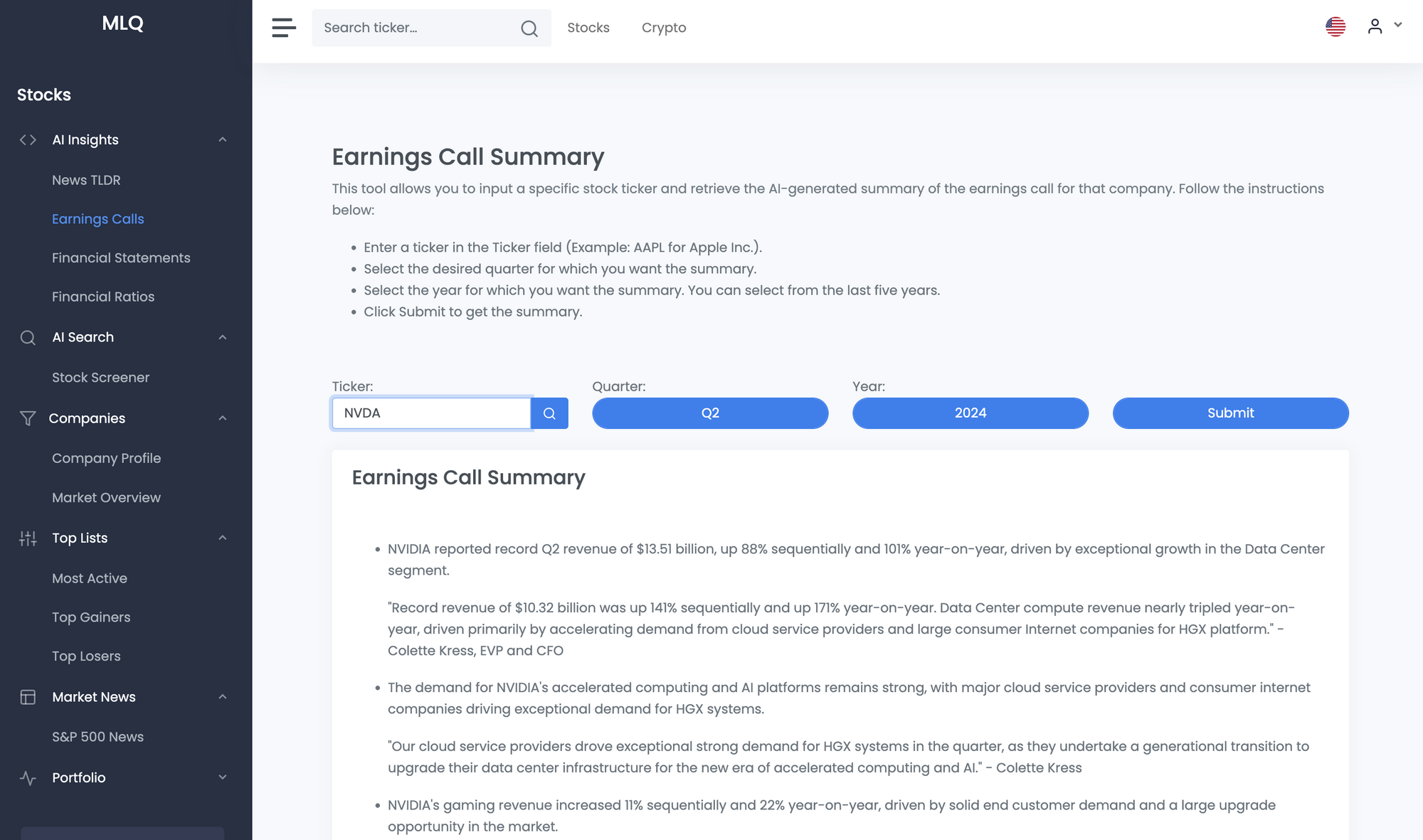

Q2 2024 Earnings Call Summary

NVIDIA reported record Q2 revenue of $13.51 billion, up 88% sequentially and 101% year-on-year, driven by exceptional growth in the Data Center segment.

"Record revenue of $10.32 billion was up 141% sequentially and up 171% year-on-year. Data Center compute revenue nearly tripled year-on-year, driven primarily by accelerating demand from cloud service providers and large consumer Internet companies for HGX platform." - Colette Kress, EVP and CFO

The demand for NVIDIA's accelerated computing and AI platforms remains strong, with major cloud service providers and consumer internet companies driving exceptional demand for HGX systems.

"Our cloud service providers drove exceptional strong demand for HGX systems in the quarter, as they undertake a generational transition to upgrade their data center infrastructure for the new era of accelerated computing and AI." - Colette Kress

NVIDIA's gaming revenue increased 11% sequentially and 22% year-on-year, driven by solid end customer demand and a large upgrade opportunity in the market.

"Just 47% of our installed base have upgraded to RTX and about 20% of the GPU with an RTX 3060 or higher performance." - Colette Kress

The Professional Visualization segment saw strong growth, driven by the ramp of the Ada architecture and the adoption of RTX technology in new workloads such as generative AI and large language model development.

"These will include powerful new RTX systems with up to 4 NVIDIA RTX 6000 GPUs, providing more than 5,800 teraflops of AI performance and 192 gigabytes of GPU memory." - Colette Kress

NVIDIA's software business continues to grow, with hundreds of millions of dollars in annual revenue. The NVIDIA AI enterprise software is being included with many of their products, further contributing to revenue and margin growth.

"Now we're seeing, at this point, probably hundreds of millions of dollars annually for our software business... NVIDIA AI enterprise to be included with many of the products that we're selling..." - Colette Kress

Disclaimer

Please note this pages serves informational purposes only and does not constitute an endorsement of any stock or investment. Please see our full Terms of Service for more.